UPS & Small Businesses

📌Summary

Timeframe

16 weeks

My Role

Lead UX Researcher

Team

Stephanie Kim, Hannah Agbaroji, Liyuan Sun, and Jingxuan Wang

Methods

Website Analysis, Task Analysis, Stakeholder Interview, User Interview, Survey, Contextual Inquiry, Competitive Analysis

Tools

Qualtrics, Figma, Figjam, Dedoose, Miro

Client

United Parcel Service (UPS)

UPS is a premier package delivery company that leads in providing global supply chain services and solutions. They are known for delivering for 1.6 million shipping customers to 11.1 million delivery customers across over 200 countries/territories.

Objective

To enhance the experiences of small business owners who work from home during the shipping process.

How can we help make the UPS shipping process more comfortable for small business owners?

How can we facilitate direct relationship-building between our users and UPS.com?

Solution

A redesigned personalized dashboard on the UPS.com website for Micro and Small Enterprises (MSE's) of varying maturity levels that makes shipment activities and services centralized, easily accessible, and personalized to the business’ profile and maturity. This will allow MSE's a personalized shipping experience that is more convenient, efficient and conducive to business growth.

My Contribution

Much of my experiences as a Lead UX researcher on my team included assisting in the data collection, creation of protocols and leading the execution of the methods agreed upon for each stage of our research process. When conducting the competitive analysis, I was responsible for researching two companies based on the agreed upon categories. During the creation of the task analysis, I assisted with developing and organizing the task goals as well as the analysis of findings in collaboration with the team. For stakeholder interviews, I created the questions we expected to ask the store managers, conducted both interviews and analyzed the data in order to narrow our focus in our final set of methods. When producing and deploying our survey, I worked on creating the questions we wanted to ask our target group based on the previous insights. My part in the deployment of the survey included going to local pop-up markets for small business owners in both my campus area and hometown as well as posting flyers on social media websites and UPS stores in the local area. With our final method, I worked on creating the user interview questions, interviewed small business owners in the Metro-Atlanta area, and analyzed the data with a teammate to come to our final findings for our design.

Research and Findings

Research Question 1:

How do MSEs currently engage in shipping and logistics out of their own homes?

Research Question 3:

What constraints do MSEs face in handling their shipping and packaging independently?

Research Question 2:

What do MSEs operating out of homes value in the shipping and logistics provided by carriers?

Research Question 4:

What goals motivate MSEs to make certain decisions within the shipping and logistics process?

Based on our problem space and background research research questions were cultivated to kickstart or research plan:

Research Methods

Website Analysis

Competitive Analysis

Contexual Inquiry

Task Analysis

Survey

Stakeholder and User Interviews

Website Analysis

We wanted to investigate the information architecture of UPS website and the steps users would take when interacting with the online shipping services.

An Interaction Map was created in order to organize and analyze what we discovered from the website walkthrough. We examined the relationship between different pages and discussed if the UPS website provides a reasonable paths to pointed user task.

Website Walkthrough Map

.png)

Web Analysis Findings

Information was spread out

The three tiers of relationships users can have with UPS are very ambiguous

No accessible services were found throughout the website walkthrough

The UPS site offers a wide variety of customer support options for businesses

We were able to learn about the surface level experiences any user of the UPS.com site would have and gave us insight into the shipping process through a shipping a delivery service.

Competitive Analysis

Upon learning more about the features offered and information architecture of UPS our new goal to understanding our users is:

What are the strengths and weaknesses of frequently used shipping and logistics features between UPS, its competitors and its indirect competitors?

From the walkthrough data discovered, we determined a set of features that were most important to small businesses and began investigating UPS, their competitors and collaborators. The other companies were determined based on prior research and information provided from our client.

Using a 2-axis chart, we listed out what we found on the features we investigated across all the companies we collected in order to centralize and identify patterns among the data.

7 competitors (2 carriers, 2 3PLs, 3 E-commerce)

14 categories with 4 focused on accessibility, 5 focused on stages of shipping process, 2 on MSE-specific features

Competitive Analysis Findings

We found that when comparing our list of features between UPS an their other market competitors/collaborators, UPS lacks in providing easily accessible resources and features for businesses to use for their growth, an important factor to consider when working with small and micro businesses who do not have a variety of outlets to grow their business from.

Contextual Inquiry

To understand the subconscious decision that MSE's make during the shipping process, a contextual inquiry was conducted with two of our users. This was our opportunity to talk with our users directly and learn through them what running a small business is like.

Participants were recruited by identifying family and friends that were small business owners who either had their business currently running or could walk us through the steps they made when shipping a parcel. The sessions were completed virtually and lasted 2 hours total, with the first have being a priming/interview section and the other half was set for observation while users completed their shipment order work flows. The participants provided general information about business history and discussed the physical and online services and tools they use after receiving confirmation of an order. We made sure to make regular interjections to get context on why certain decisions were made, understand what the MSE was thinking, and to probe them on additional questions we had. Field notes were taken while the participants took us through each step of the shipping process.

An experience map was used to organize the data found from the interview including questions, feelings and decision processes MSEs have along the way, providing context to the decisions behind of shipping a package.

Contextual Inquiry Findings

We found that users value being highly involved with the status of their parcels and frequently consider convenience, reliability, and cost.

Task Analysis

After discovering the features offered by UPS in comparison to other competitors, our goal now is to use task analysis to investigate the end to end experiences when shipping items. From this point further, we are trying to understand the steps our users take to fulfil their main objective and to have an understanding of what high-level decisions users will make at each stage of the shipping process. With the use of the findings from Contextual Inquiry and Proxy data , the team began with an anachronistic list of all goals, sorted goals, then built and sorted each of our users tasks within each goal. This process was iterative and was updated until it was finalized.

A task analysis flow chart was created with 9 key steps, starting from locating an order to managing returns and claims. In each step, there is an associated goal as well as subtasks for the goals.

Deciding the platform in which to manage orders and shipping process (Goal 3) has the greatest number of possible subtasks

No accessible services were found throughout the website walkthrough

Goals 3 and 8 are the most variable, containing several different options that can drastically change the business model

Depending on combinations of carriers, selling platforms, order management platforms used, tracking model is distinctly located

Task Analysis Findings

Stakeholder Interview

To better understand the shipping process experience, we interviewed two UPS store franchise managers in the local Midtown Atlanta area for an hour and generated an affinity map to analyze the data. Our goal was to understand how services offered differ between in-store and online while also understanding the relationship users have with UPS through the perspective of our stakeholders who interact with them most.

Interview guidelines using the findings from the website walkthrough and task analysis. The website walkthrough informed us of the UPS-specific services to compare with the store services while task analysis informed us the range of questions to span the whole shipping and logistics process.

UPS drivers are independent from the UPS franchise stores and run their own way

There are many in-store services such as the mailbox services and printing services which are useful for business owners for managing their package and business addresses

There are issues with UPS store services such as package pickup, returns and customer service

UPS stores and UPS warehouse have a more distant relationship that customers are not very aware about

Some hidden services that UPS offers but customers are not aware about such as the variety of printing services that small business could benefit them, alternative UPS network drop-off/pick-up options

Small businesses seek cheaper shipping price

Stakeholder Findings

Survey

To better narrow our focus, we used a survey to understand how and why users decide on their selling, order management, and/or carrier platforms. It was also a chance to understand what stages of the shipping process and features in the stages users prioritize.

Questions were formulated and centered around how businesses decide on selling and order management platform. The questions were based on the stakeholder interview analysis, CI findings, and task analysis. Recruitment was done through snowball sampling, in-person visits (farmer's markets), private messaging, posting on social media and email lists.

After looking through the quantitative and qualitative data from the Qualtrics survey, we used the descriptive statistics tools, graph visualization features and grouped the free responses by key words in a spreadsheet in order to come to a conclusions.

Most businesses are micro-businesses, working in crafts + operating out of home.

Most businesses choose their carrier based on rate comparison and reliability.

Most business are on E-commerce and 3PL platforms for order management.

Package tracking generated the most free-text response keywords out of any other aspect of the process.

Survey Findings

User Interviews

To finalize a deeper understanding of the survey results, we developed questions for our user interviews in which we gather general, ad hoc sentiments on the shipping process as a whole. Even so the questions are general, we were focusing on interviewing:

-

Businesses who filled out a survey with a few people who did not.

-

Businesses that sell arts and crafts and clothing and accessories sectors specifically

Once we completed our six user interviews, we used google sheets to organize summarized statements and code for themes. Data was organized based on how it related to survey findings then began creating second level data and then created the key findings based on the themes created from the second level data.

Interview Findings

Much of what was said during interviews was similar to what we found in the survey but with added detail and explanations that could not be seen in the survey. There were also thinks in the specific pain points found in the survey that were not as prominently found in the interviews.

Final Insights

Convenience

MSE's are generally pressed for time and need to be able to ship out orders efficiently

Reliability

Reliable package tracking & delivery (and the visibility of such) is a key priority for MSE's

Agency

MSE's want to maximize control over the entirety of the shipment process

Business Model

Business characteristics dictates their choice of selling and order management platform

Findings to Design

With our final findings, we were able to translate them to a set of user needs to help inform us of our users desire for when going through the shipping process.

I want an order management platform that centralizes all the information I need, saving me time and offering the most ease of use.

I need to have flexibility with drop off and pick up options to suit my shipment volume.

I need to be able to quickly compare shipping rates across shipping services in order for the shipping process to be cost-efficient for me.

I want to understand what insurance options will help my business minimize financial losses on claims.

I need to understand my packages' status at all times and in a punctual manner.

I want carriers to offer better advertising and branding services that would benefit business growth.

I want to learn more about how to build trusting relationships with my carriers.

From the user needs, We then create design implications that integrates each of our user's needs into an element of our final design.

System should display order management tools on centralized dashboard immediately to user.

System should reorganize claim management guidance to be more transparent and actionable for businesses.

System should allow for straightforward comparisons of shipping rates.

System should communicate consistently to small business owners about applicable services.

The package tracking system data should visualize the package's journey for users to easily understand and interpret.

System should encourage direct interaction with carriers' online and in-person services in shipping an item.

System should redesign the pick up process to make it more reliable and safe.

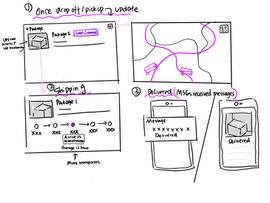

Design Sketches

Evaluation

Once our final sketches were agreed upon, our team conduct feedback session with HCI experts and UX researchers at Georgia Tech and at UPS. Experts were able to answer questions and score each of the sketches shared with them. Affinity Mapping and Evaluation Metrix was used to analyze the data received and found that the personalized dashboard was top-rated by both types of experts.

Once wireframes were created, we tested them with users of our product. We were evaluating relevance and usability of “Create a shipment” and dashboard wireframes. Overall, a widget-based personalized dashboard was the most favored among the users.

What I Learned

-

It is important to have a rationale to every method or choice used when going through the research and design process

-

I learned how to execute different UX research methods while also understanding when it is best to use them.

-

I realized how teamwork can offer the opportunity to uncover other ways of approaching information and provide more information that was not considered before